Good morning, readers!

We report to you from Nashville, Tenn., where HRF’s Financial Freedom team is here for a range of activities around the Bitcoin Conference. Notably, HRF is sponsoring the Open Source Stage, running a booth about FOSS Bitcoin development in the expo (come visit!), speaking on the main stage tomorrow and Saturday at 11:30 a.m. local time, signing books, and making some special announcements. Stay tuned!

Across the world this week, authoritarian regimes predictably continue leveraging centralized technologies and top-down policies to tighten their grip on power. In Russia, Vladimir Putin pushes for harsh regulations on Bitcoin mining, citing fears of potential power outages. These measures would grant the regime unilateral control over where Bitcoin can be mined and who can mine it. While cracking down on access to an open network, he is simultaneously advocating for an expansion of a central bank digital currency (CBDC). This would inevitably grant his regime unprecedented control over individual financial transactions.

In Bangladesh, thousands of students protested an outdated quota system that reserves 30% of highly sought-after government jobs for descendants of the 1971 War of Independence — many of whom are political elite. The regime responded with military action and an internet shutdown, leaving students injured, more than 150 killed, and protesters unable to coordinate or communicate their efforts.

On the technology front, Blue Wallet introduced the ability for users to send to Silent Payment addresses, helping support the work of activists and nonprofits through discreet donations. Meanwhile, a new project called TwelveCash aims to simplify Bitcoin Lightning payments by introducing memorable and human-readable addresses that resemble email handles. Both projects help with respect to receiving donations in a more private way.

We end with the latest episode of the HRF x Pubkey Freedom Tech Series featuring HRF’s operations lead, Arsh Molu, interviewing HRF’s nonprofit Bitcoin adoption lead, Anna Chekhovich. They discuss the importance of privacy in political activism, highlighting Chekhovich’s work at the Anti-Corruption Foundation in Russia, which relied upon private Bitcoin donations to remain operational.

Now, let’s dive right in!

The Financial Freedom Report is a newsletter focusing on the role currency and banking play in the civil liberties and human rights struggles of those living under authoritarian regimes. We also spotlight new tools and applications that can help individuals protect their financial freedom.

Russia | Putin Criticizes Bitcoin Mining While Pushing for CBDC Expansion

Russian dictator Vladimir Putin is calling for stringent regulations on Bitcoin mining in Russia. He cites electricity consumption as the cause of power shortages happening in various areas, especially in Siberia. “The issue is acute and fraught with serious consequences,” he said, as he pushes for expanded government control over Bitcoin mining operations. In reality, Bitcoin mining doesn’t compete with or crowd out other power demand, so this is transparently a political power move. Putin is also advocating for a “wider, full-scale implementation” of the Russian central bank digital currency (CBDC), the digital ruble. A CBDC would grant complete visibility and control over all Russian transactions and enable the regime to monitor, restrict, and manipulate financial activities at will. The Bank of Russia has already piloted a CBDC to select populations and expects to issue the CBDC to the wider public in 2025.

Bangladesh | Students Protest Quota System

Thousands of students in the capital city of Dhaka are protesting a controversial quota system that reserves 30% of government jobs for descendants of those who fought in the 1971 War of Independence (many of whom are political elite). With high youth unemployment (40%) and persistently high inflation, government jobs are seen as a path to job security and higher pay. The government responded by deploying the army (resulting in at least 163 deaths and numerous injuries), shutting down the internet, and imposing a midnight curfew. The nationwide internet shutdown shuttered ATMs and online money services in one fell swoop, leaving demonstrators unable to communicate, coordinate, and fund their protest efforts. Much like in Kenya earlier this year, the demonstrations did in part work, prompting Bangladesh’s Supreme Court to scale back the quota to 5%. Students welcomed this decision but have chosen to continue demonstrations until their other key demands are met, including the release of jailed students and resignations of officials responsible for the unmerited violence.

Burma | Military Funds War Through Rigged Forex Policy

In Burma, the regime is using foreign exchange policies to fund its military operations at the expense of the nation’s economy and citizens’ financial freedom. The military-controlled Central Bank of Myanmar (CBM) is now enforcing the conversion of export earnings and remittances at artificially imposed rates fixed well below the market rate. Additionally, the CBM’s forex trading platform, which launched in June 2023, allows the CBM to dictate who is approved to access Burma’s annual $8 billion forex flow. Critics argue this ties the economic outcomes of firms to relationships with the military regime. Together, these measures have enabled the regime to siphon off revenue equal to 6.4 trillion kyrat ($1.8 billion) from its population in order to fund its military expansion (an amount comparable to the entire military budget and exceeding 2023 income tax revenue as well as revenue from natural resources). This extraction of wealth undermines the free market and its participants, pushes businesses and individuals to black-market transactions, limits access to fair financial transactions, and decreases economic stability.

Nigeria | Claims Funds in Dormant Bank Accounts

The Central Bank of Nigeria (CBN) issued revised guidelines mandating banks to transfer “dormant” account funds and unclaimed balances to the CBN. This directive allows the CBN to seize inactive funds without direct consent from account holders, further eroding trust in the Nigerian banking system. Given the regime’s tight control over the financial sector —including the ban on peer-to-peer trading of the local currency, the issuance of central bank digital currencies (CBDCs), taxes, and fines imposed on the use of digital assets — this move is seen as deepening financial hardships for Nigerians, who now, on top of record inflation, risk losing their dormant savings. Critics argue this move is a form of expropriation as it strips citizens of their rightful funds and financial autonomy. Savings is a valuable use case for money, and today in Nigeria it is under attack. With rising concerns over oppression committed by Nigerian financial institutions, the popularity of Bitcoin and stablecoins continues to grow.

Kenya | Walkie-Talkie App Zello Unlikely Saviour in Historic Youth Protests

Kenyan youth turned to the walkie-talkie app Zello to coordinate their movements during protests against a controversial tax bill that would increase taxes on essential goods while bailing out a corrupt regime. This summer, Zello enabled thousands of young protesters to communicate in real-time, as people downloaded the app more than 40,000 times to alert each other to police presence, tear gas locations, and safe routes, even with the Internet down. Looking to the future, unique innovations like mesh networks — where interconnected nodes relay data to one another — built upon decentralized social protocols like Nostr could provide even more resilient tools for citizens to stand up against tyranny.

Blue Wallet | Implements Sending to Silent Payment Addresses

Blue Wallet, a popular non-custodial mobile Bitcoin wallet, now supports sending to Silent Payment addresses. This static address protocol for Bitcoin allows transaction senders to generate unique addresses from a receiver’s static public key. Silent Payments are a big privacy boost and can be especially useful for activists receiving donations, tips, or funding. With this update, Blue Wallet joins other wallets like Cake Wallet in enhancing financial privacy through the integration of Silent Payments. You can learn more about Silent Payments in this comprehensive guide and learn about Blue Wallet from this tutorial by prolific educator, BTC Sessions.

TwelveCash | Simplifying Lightning Addresses

TwelveCash aims to simplify the process of receiving Bitcoin payments by providing a memorable identifier (i.e., an email-like payment address) instead of a traditional Bitcoin address made up of a long string of letters and numbers. TwelveCash leverages BIP 353 and Domain Name System (DNS) technology to securely manage payment instructions. When someone uses a TwelveCash address, it can redirect them to a BOLT 12 offer, a Lightning address, an on-chain address, or a Silent Payment address. By transforming complex payment details into simple, memorable addresses, TwelveCash makes sending and receiving Bitcoin payments more accessible and user-friendly for Bitcoin users and activists around the world.

Calle | Demos Nostr Web Services

Bitcoin developer and creator of Cashu, Calle, released a demo of Nostr Web Services (NWS), which brings Transmission Control Protocol (TCP) to Nostr. What this means is that users can host web applications without needing a Domain Name System (DNS) — a naming system used to translate human-readable domain names into machine-readable IP addresses — or revealing their public IP address. Instead, users share their service’s npub (Nostr public key), ensuring private communication through encrypted connections. This development allows for more private and secure hosting and accessing of web services. For those in challenging political environments, NWS could provide a way to bypass traditional Internet infrastructure to communicate and carry out commerce without being monitored by authorities.

Bitso | Integrates Lightning Network

Bitso, a leading financial services company in Latin America, integrated the Bitcoin Lightning Network. This move will allow Bitso’s eight million retail customers and 1,700 institutional clients to enjoy faster, more affordable Bitcoin transactions. Partnering with Lightspark, Bitso will use Lightspark’s remote key signing implementation, meaning Bitso will hold the Lightning signing keys while Lightspark hosts the Lightning node. With 53% of wallets in Latin America holding Bitcoin (according to Bitso’s Crypto Landscape in Latam report) and significant adoption in the region’s authoritarian regimes, this integration will enable real-time, cost-effective Bitcoin payments amid the region’s political and currency challenges.

El-Tor | High Bandwidth Tor Network

El-Tor is a high-bandwidth Tor network incentivized by the Bitcoin Lightning Network. It enables users to run their own Tor relays and earn satoshis for sharing their Internet bandwidth. By also integrating BOLT 12 offers, El-Tor ensures that payments to users are more private and censorship-resistant. Users of El-Tor can choose to run different types of Tor relays based on their needs and use cases — entry guard, middle relay, or exit relay — and set custom rates for their services. This project aims to enhance internet privacy and resiliency by providing financial incentives to support the Tor network. El-Tor showcases Bitcoin’s expanding role in building decentralized and secure Internet infrastructure, reducing reliance on centralized systems, and promoting financial freedom.

NIP 88 | Discreet Log Contracts over Nostr

Discreet Log Contracts (DLCs) are Bitcoin-based smart contracts that allow users to enter into agreements with each other. Outcomes are determined by oracle, which are services that supply external data to blockchain-based smart contracts. In other words, they act as a bridge between the real world and the blockchain to determine the outcome of a smart contract. A Stacker News post suggested that Nostr could act as a “layer of discoverability for DLC oracles.” This would allow anyone with an Internet connection to become an oracle, help decentralize the process of DLCs, reduce the risk of censorship, and lower the barrier to entry. Additionally, combining DLCs with the Lightning Network or eCash could enable instant settlement for contracts.

Maelstrom | New Bitcoin Developer Grant Program

Maelstrom, a decentralized technology fund, launched a new Bitcoin Developer Grant Program to support open-source developers working on Bitcoin’s technical progress. Led by Arthur Hayes, co-founder of BitMex and CIO of Maelstrom, and piloted by Jonathan Bier, the author of “The Blocksize War,” the program aims to enhance Bitcoin’s “resilience, scalability, censorship resistance, and privacy characteristics.” Grants range from $50,000 to $150,000 and are awarded for a duration of 12 months. This initiative is crucial to helping support the work of open-source developers and driving the ongoing development of Bitcoin. Developers are invited to apply by Aug. 25 for the chance to receive funding. Learn more about the Bitcoin Developer Grant Program and apply here.

Recommended Content

Upcoming Keynote Addresses by Alex Gladstein at Bitcoin 2024

Don’t miss keynote speeches from Alex Gladstein, HRF chief strategy officer, at the Bitcoin 2024 conference this week in Nashville, Tenn. Gladstein will deliver two 30-minute keynotes Friday, July 26, and Saturday, July 27, at 11:30 a.m. local time in front of an audience of 6,000+ on Bitcoin’s global utility: the first on “Commerce and Freedom” and the second on “Power.” The talks will be livestreamed here.

The Dangers of CBDCs with Nick Anthony

In the latest episode of HRF’s Dissidents and Dictators podcast, Nick Anthony, a policy analyst at the Cato Institute, discusses how central bank digital currencies (CBDCs) pose threats to financial privacy, freedom, and human rights. Drawing from his work on the HRF CBDC Tracker, which charts the development of CBDCs worldwide, Anthony contrasts centralized CBDCs with decentralized currencies like Bitcoin, concluding that they’re fundamentally different. He also highlights the lack of adoption for CBDCs, citing the Nigerian government’s rushed rollout of the eNaira, which led to severe restrictions on cash withdrawals and sparked public protests. This episode offers crucial insights into the real-world implications of CBDCs on financial autonomy and human rights globally. If you’re a human rights defender, we encourage you to watch the full interview here.

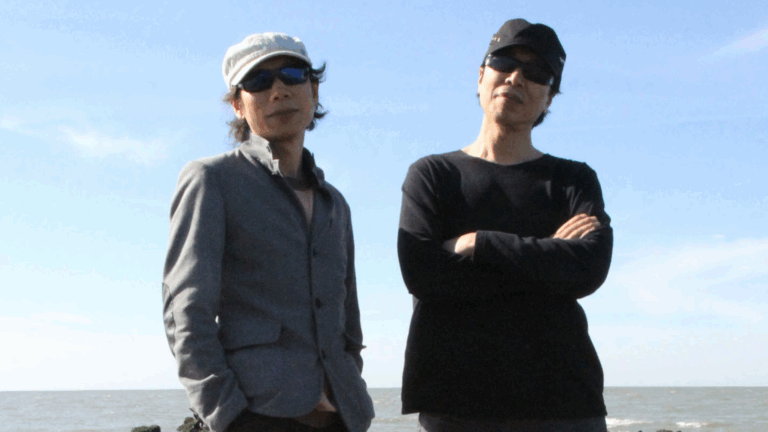

HRF x Pubkey — Financial Privacy is a Human Right with Anna Chekhovich

In the latest installment of the Freedom Tech Series, HRF’s Arsh Molu interviews Anna Chekhovich, HRF’s nonprofit Bitcoin adoption lead, about the importance of financial privacy in political activism. Chekhovich shares her firsthand experience working with the Anti-Corruption Foundation (ACF) in Russia, where Bitcoin was crucial after Putin’s regime froze their bank accounts. Bitcoin enabled the ACF to continue operations and pay rent and salaries despite severe financial restrictions. Chekhovich explains how Bitcoin’s apolitical, censorship-resistant, and unseizable nature protects activists, organizations, and supporters from political and financial persecution by authoritarian regimes. Watch the full interview to learn how Bitcoin is protecting human rights and financial privacy worldwide.