Good morning readers,

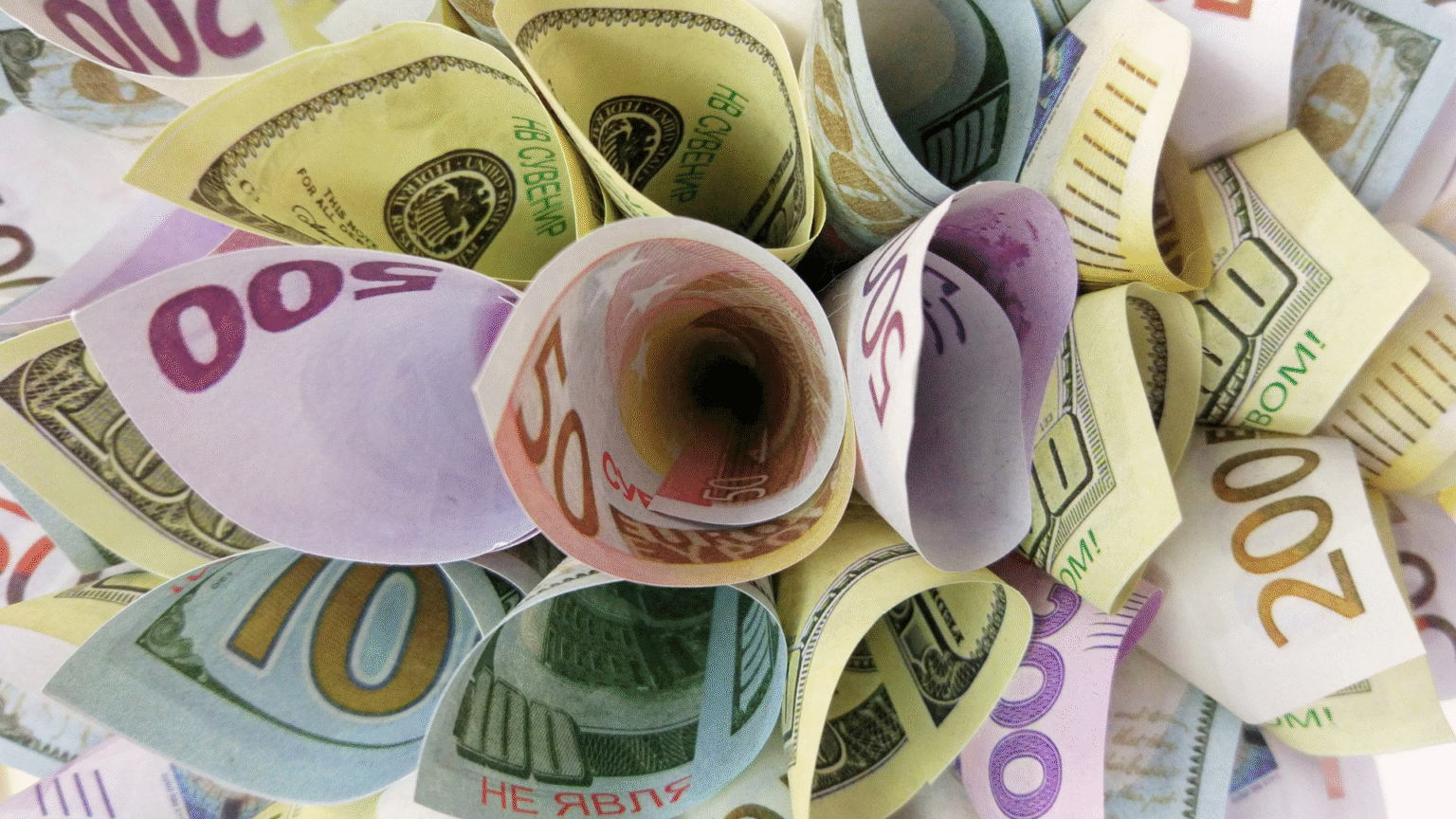

In Kenya, the central bank warned that making Valentine’s Day bouquets out of banknotes could carry prison sentences of up to seven years. While officials frame the move as protecting currency integrity, the severity of the punishment indicates how seriously the government is trying to protect the image of the shilling.

In Bitcoin news, a $1 million transaction was successfully completed over the Lightning Network, demonstrating the network’s growing capacity to move large amounts of value quickly with minimal fees. The transaction challenges the perception that Lightning is limited to small payments and underscores its potential as a settlement tool outside traditional, intermediary-heavy financial systems.

We also highlight a podcast episode featuring Russian dissident Anna Chekhovich, who describes how her US bank accounts were frozen after she was labeled an extremist by Vladimir Putin’s dictatorship, illustrating how financial repression can follow activists even beyond authoritarian borders.

Let’s follow these threads into the full report.

Global News

Kenya | Central Bank Warns Banknote Bouquets Could Land You in Jail

Kenya’s central bank warned Kenyans in the lead-up to Valentine’s Day that making bouquets out of colorful banknotes could be punished with a seven-year jail term. Officials argue that banknotes used in bouquets are often “folded, rolled, glued, stapled, pinned,” or otherwise damaged, which they say compromises their integrity, defaces the national currency, and increases the cost of replacing damaged notes.

In context: While the central bank frames the warning as a matter of protecting currency integrity and reducing costs, the severity of the potential punishment for non-harmful uses of cash raises proportionality concerns and shows what a sore spot the weak state of the shilling is for the Kenyan government.

Russia | Throttling Telegram to Push State-Backed Messenger

Russian officials are actively throttling the use of Telegram in a bid to push Russians toward the state-backed messaging app Max, which also integrates digital payments. Users across the country have reported disruptions, including blocked voice calls and overall slower services. Pavel Durov, founder of Telegram, decried the move and described Max as “a state-controlled app built for surveillance and political censorship.” Officials justify the measures as securing “compliance with Russian law and the protection of citizens,” but critics and rights groups see this slowdown as a blatant attempt to increase control and surveillance over communications and the internet. Russian officials have previously restricted access to other messaging apps, including by throttling WhatsApp since mid-2025.

In context: Pairing messaging and payments inside a single state-backed platform would allow officials to centralize financial and communications surveillance, further narrowing the already tightly restricted space for privacy and free expression in Russia.

Vietnam | Levy on Cryptocurrency Transactions Proposed

Vietnam’s finance ministry is proposing draft regulations that would impose a 0.1% tax on cryptocurrency transactions made through “licensed service providers,” according to the Hanoi Times. The levy would apply to individuals each time a digital asset is transferred or traded, regardless of whether the transaction results in a profit or a loss. Under the same proposal, companies wanting to operate exchanges would face high barriers to entry, including a minimum capital requirement of more than $400 million, far exceeding thresholds for most other industries in Vietnam.

In context: Vietnam ranks highly in global digital asset adoption, but these regulations make digital assets like Bitcoin more expensive to use. Because the tax applies only through licensed providers, it creates a strong incentive for officials to push activity into regulated platforms, surveil transactions more closely, and link identities to financial behavior, something that is obviously worrying under an authoritarian regime.

Philippines | Central Bank Plans to Introduce Wholesale CBDC

The Philippines’ central bank is planning to introduce a wholesale central bank digital currency (CBDC) to facilitate the settlement of government bonds between banks. This move follows the country’s 2023 initiative to sell government debt to the public as digital tokens. The tokenized bonds were primarily distributed through GCash, a popular digital wallet app, and PDAX, a local digital asset exchange.

In context: This initiative reflects a global trend of central banks embedding themselves more deeply into electronic financial infrastructure. Promoting government debt through popular consumer platforms could steer users toward government liabilities rather than open and free alternatives like Bitcoin. Even when limited to wholesale use, systems like the upcoming CBDC and tokenized debt can shape how markets operate, who can participate, and how closely financial activity is monitored, with long-term negative implications for financial freedom on an individual and national level.

China | Yuan-Pegged Stablecoins Remain Banned on the Mainland

China’s financial regulators have reiterated that issuing yuan-pegged stablecoins or tokenizing real-world assets (RWAs) remains illegal on the mainland. This applies to both domestic and foreign entities operating within China. However, the statement notably does not impose a blanket ban on offshore yuan stablecoins. Instead, regulators suggested that offshore issuance could be possible with explicit approval. Chinese officials cited familiar concerns to justify the domestic ban, including a lack of customer identification and anti-money-laundering controls, conflicts with China’s capital controls, and risks to monetary sovereignty.

In context: China is holding the line on stablecoins at home while cautiously exploring tightly controlled, fully identifiable offshore alternatives, reinforcing its priority of maintaining monetary control rather than enabling open digital currency use. It may “sandbox” the use of yuan-pegged stablecoins abroad before it brings them home.

Recommended Content

Debanked for Dissent: How Putin’s Reach Extends Abroad with Anna Chekhovich

In this CATO Podcast episode, Russian dissident and financial director of the Anti-Corruption Foundation, Anna Chekhovich, discusses her recent experience of having her US bank accounts frozen after the Kremlin labeled her an extremist. She explains her experience with financial exclusion both at home in Russia and abroad in the US, and discusses how political labels and interconnected global financial systems enable authoritarians like Vladimir Putin to export financial repression beyond their own borders.

Bitcoin and Freedom Tech News

Voltage | $1 Million Lightning Transaction Facilitated

Voltage, a cloud provider for the Bitcoin Lightning Network, completed the first $1 million Lightning Network transaction. The Lightning Network is an application layer for Bitcoin that enables users to make bitcoin payments more rapidly, at lower cost, and with greater privacy. The transaction challenges the narrative that the network is limited to small payments, showing that the size of payments is constrained not by the protocol but by liquidity and routing management.

Why this matters: Moving $1 million with near-zero fees and immediate finality highlights a level of efficiency that traditional banking and many other digital assets cannot achieve without intermediaries, delays, or significant cost. For civil society organizations, the ability to move large amounts of value quickly and without reliance on intermediaries reinforces Bitcoin’s growing role as an alternative settlement network outside of authoritarian control.

Sigbash | Sigbash v2 Now Live

Sigbash, a Bitcoin co-signing service, released Sigbash v2, introducing a new approach it calls oblivious signing for Bitcoin multisignature custody. Sigbash helps organizations and individuals add safeguards to their bitcoin funds (such as requiring approvals, limits, or conditions to access or move funds) without handing control to a third party. Sigbash v2 enables Sigbash to co-sign users’ transactions without ever seeing private keys or transaction details. Instead, users set clear spending rules in advance — for example, where funds can be sent, how much can be spent, or when transactions are allowed — and Sigbash will only approve payments that meet those rules.

Why this matters: For activists and civil society groups, Sigbash can protect funds against misuse or theft without exposing sensitive financial information to authoritarian regimes.

Ibis | New Bitcoin Wallet Releases Android Beta

Ibis is a new Android Bitcoin wallet designed to bring advanced functionality to a mobile environment. Recently released in beta, the wallet includes native Tor integration, allowing users to connect to the Bitcoin network without exposing their IP address. It also supports transaction fees below the standard minimum of one satoshi per virtual byte. Ibis also offers Partially Signed Bitcoin Transactions (PSBTs), which are commonly used in multisig setups and when transacting with hardware wallets, as well as coin control, allowing users to select which bitcoins they spend to improve privacy and fee efficiency.

Why this matters: While currently only suitable for test funds, the combination of features could make Ibis an intriguing option for dissidents operating under financial repression.

Gloria Zhao | Bitcoin Core Maintainer Steps Down

Gloria Zhao, a prominent Bitcoin developer and researcher, has officially stepped down from her role as a Bitcoin Core maintainer. Bitcoin Core is the most widely used implementation of Bitcoin, with nodes running the software to verify transactions and enforce the network’s consensus rules. In 2022, Zhao became the first woman to serve as a Bitcoin Core maintainer. During her tenure, Zhao contributed to improvements in mempool validation and peer-to-peer transaction relay, areas critical to how transactions propagate and are validated across the network, with significant relevance to improvements in the Lightning Network. Last week, she requested that her cryptographic keys be removed from Bitcoin Core’s list of trusted maintainers, formally marking the end of her role.

Why this matters: Bitcoin Core maintainers play a key role in safeguarding the software by reviewing and approving changes before they are adopted by the broader network. With Zhao’s departure, Bitcoin Core’s five other maintainers will continue to perform this role.

Hydra Pool | Nostr Integrated into HashDash Dashboard

Hydra Pool, an open-source and self-hosted Bitcoin mining pool, has added Nostr integrations to its monitoring dashboard, HashDash. The dashboard provides users with pool information, such as statistics and updates. With the integration, users of Hydra Pool can identify themselves using Nostr public keys and share pool information over the Nostr network instead of centralized web services. The update makes Hydra Pool the first known Bitcoin mining pool to support Nostr-based coordination at the dashboard level.

Why this matters: Mining pools rely on coordination and communication layers. Using Nostr’s decentralized communications protocol may reduce reliance on centralized dashboards and account systems, improving resilience and the ability to mine independently under restrictive regimes.

Summer of Bitcoin | Applications Open for 2026 Summer Cohort

Summer of Bitcoin, a not-for-profit organization and HRF grantee training students across the world in Bitcoin development and design, recently opened applications for its 2026 summer cohort. Applicants can choose the developer track to contribute to Bitcoin’s open-source code or the designer track to work on user interface improvements for Bitcoin tools and applications. It’s a great opportunity for students around the world, especially those in dictatorships, to build on Bitcoin, create new tools, and gain the necessary skills to make open contributions to this emerging monetary system.

Recommended Content

Why Payjoin Matters for Privacy with Dan Gould

In this recording of a recent bitcoin++ event in Taiwan, Dan Gould, executive director of the Payjoin Foundation, explains Payjoin and emphasizes privacy as essential to maintaining censorship resistance. Payjoin is a privacy technique that works by mixing inputs of a bitcoin payment with inputs from the recipient, making it harder for outside observers to trace who paid whom. It is a feature available in Bitcoin wallets such as BULL and Cake, and can break surveillance heuristics like chain analysis that dictators use to surveil the blockchain.