The Financial Freedom Report is a newsletter focusing on how currency plays a key role in the civil liberties and human rights struggles of those living under authoritarian regimes. We also spotlight new tools and applications that can help individuals protect their financial freedom.

Good morning, readers!

Turkey’s currency plunged to a record low after the arrest of Istanbul Mayor Ekrem Imamoglu, one of President Recep Tayyip Erdogan’s main political rivals. This follows a pattern of escalating repression of opposition figures, which have been described as an effort to suppress competition ahead of primary elections. As economic conditions deteriorate, Erdogan is resorting to desperate measures — blocking social media, arresting dissenters, and tear-gassing protests — to maintain power over an increasingly restless populace.

In the Caribbean, we shed light on Cubans’ struggles accessing remittances sent from family members abroad. This is a symptom of the regime’s strict monetary controls over foreign currency. Cubans face long delays or can’t withdraw cash due to bank liquidity shortages. And when they can, remittances are converted into pesos at the overvalued official Cuban exchange rate. This effectively allows the Communist Party of Cuba (PCC) to loot the value from Cuban remittances.

In freedom tech news, we highlight Demand Pool, the first-ever Stratum V2 mining pool. Stratum V2 is a mining protocol designed to decentralize Bitcoin mining by letting individual miners create their own block templates rather than relying on centralized pools to do so for them. This improves censorship resistance and promotes a more decentralized and resilient Bitcoin network — critical features for human rights defenders and nonprofits using Bitcoin to protect against financial repression from authoritarian regimes.

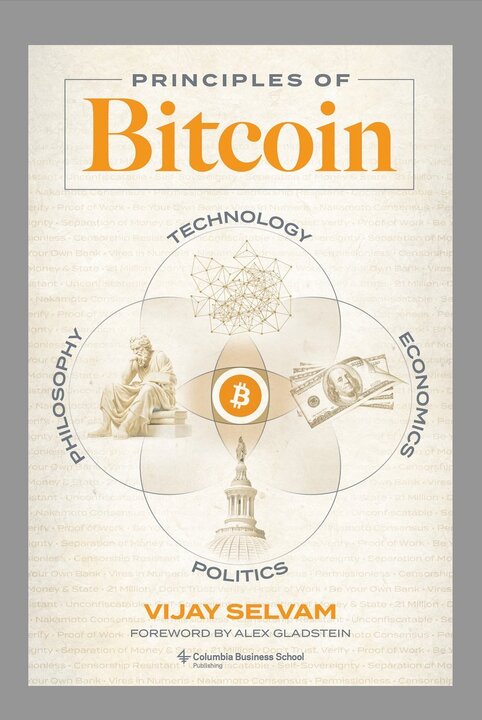

We end by featuring Vijay Selvam’s new book, “Principles of Bitcoin.” It offers a clear, first-principles guide to understanding how Bitcoin’s technology interacts with economics, politics, philosophy, and human rights. Whether you’re new to Bitcoin or looking to deepen your understanding, this book provides a solid foundation, and it even features a foreword by HRF Chief Strategy Officer Alex Gladstein.

Now, let’s dive right in!

Turkey | Lira in Free Fall as Erdogan Arrests Political Rival

Turkey’s lira plunged to a record low after officials arrested Istanbul Mayor Ekrem Imamoglu, President Recep Tayyip Erdogan’s main political rival. Imamoglu’s arrest comes ahead of primary elections and follows the increasing repression of opposition figures in recent months, including the suspension of political opposition accounts on X. Officials also arrested Buğra Gökçe, head of the Istanbul Planning Agency, for publishing data exposing the country’s deepening poverty. The currency’s fallout and political repression have sparked protests in Istanbul despite a four-day ban. The regime is responding with tear gas and rubber bullets. Meanwhile, Turks dissenting online risk joining over a dozen other citizens recently arrested for “provocative” social media posts. Netblocks reports that the Turkish regime imposed restrictions on social media and messaging to quell the uprising of Turks struggling with financial conditions and deepening repression.

Cuba | Banks “Hijack” Citizen Remittances

Cubans are struggling to access remittances sent from their families abroad. This is because the regime completely controls all incoming foreign currency transfers. When remittances arrive, communist banking authorities force their conversion into collapsing Cuban pesos or “Moneda Libremente Convertible” (MLC), Cuba’s digital currency with limited use. On top of this, Cubans receive pesos in their accounts based on the official Cuban exchange rate, which is far below the informal market rate. This allows the regime to opaquely siphon off much of the remittances’ real value. Even when the money clears, Cubans face long delays or can’t withdraw the cash due to banks’ liquidity shortages. Many Cubans are accusing these banks of “hijacking” their remittances. As inflation, electrical blackouts, and food shortages continue, remittances are more critical than ever for Cuban families. Yet, they’re blocked at every turn by a system designed to impoverish them.

Pakistan | Announces Plans to Regulate Digital Assets

Pakistan announced plans to create a regulatory framework for Bitcoin and digital assets to attract foreign investment and domestic economic activity. It’s a peculiar shift for a regime that regularly suspends the Internet, censors social media, represses opposition, and burdens its people with the highest cost of living in Asia. We suspect the plans indicate efforts to control the industry rather than empower individuals. The military-backed regime is also exploring a Central Bank Digital Currency (CBDC) and tightening controls on VPN use, which are hardly the hallmarks of leadership committed to permissionless financial systems. But perhaps it matters little. Grassroots Bitcoin adoption in Pakistan already ranks among the highest in the world, with an estimated 15 to 20 million users turning to digital assets to preserve their savings, circumvent financial controls, and escape the failures of a collapsing fiat system. HRF supported Bitcoin Pakistan with a grant to help translate resources into Urdu, a language spoken by 60 million people trapped in this repressive scenario.

Russia | Piloting CBDC in Tatarstan to Test Smart Contract Functionality

Russia’s central bank plans to pilot its CBDC, the digital ruble, in Tatarstan to test smart contract functionality. Specifically, the central bank will experiment with conditional spending, using smart contracts to restrict where and what users can spend money on. If these features are implemented, it will empower the Kremlin with micro-controls over Russians’ spending activity. Officials could program funds to expire, restrict purchases to regime-approved goods, or block transactions at certain locations — leaving users with no financial autonomy or privacy. Those who oppose the Russian dictatorship, such as activists, nonprofits, and dissenters, could be debanked with more ease, their assets frozen or confiscated without recourse.

Nicaragua | Government Mandates Public Employees Declare All Assets

In Nicaragua, dictator Daniel Ortega intensified state financial surveillance by mandating all public servants to disclose information on all personal and family assets. The mandate requires all public employees to declare everything from personal bank accounts, loans, vehicles, and other assets — as well as the assets and accounts of immediate family members. Those who do not comply face the threat of termination. Ironically, despite the law requiring such disclosure, Ortega himself has not declared his assets since 2006. Under the guise of regulatory compliance, this policy is yet another link in the chain tightening state surveillance over Nicaraguan society. Bitcoin adoption continues to grow in this repressed Central American nation.

RECOMMENDED CONTENT

Rule Breakers — The True Story of Roya Mahboob

“Rule Breakers” is a new film that tells the true story of Roya Mahboob, Afghanistan’s first female tech CEO, who empowered young girls in Afghanistan with financial literacy, robotics, and financial freedom through Bitcoin. The film recounts Mahboob’s courageous work educating these girls despite huge personal risks under a regime that bans their education. It follows the story of Afghan Dreamers, the country’s first all-girls robotics team, and the obstacles they overcome to compete on the world stage. “Rule Breakers” is a testament to the power of education, innovation, and resilience in the face of oppression. It’s now in theaters, and you can watch the trailer here.

Demand Pool | First Stratum V2 Mining Pool Launches

Bitcoin mining could become more decentralized and censorship-resistant with the launch of Demand Pool, the first mining pool to ever implement Stratum V2. Stratum V2 is open-source software that allows miners to build their own block templates, enabling more individual mining and less dependence on large and centralized mining pools. This helps maintain Bitcoin’s key features: its decentralized, permissionless, and uncensorable nature. All of which are crucial for human rights defenders and nonprofits bypassing the financial repression and surveillance of authoritarian regimes. Learn more here.

Bitcoin Mining | Three Solo Blocks Found

Three separate solo miners mined Bitcoin blocks in the past seven days. This marks the second, third, and fourth solo blocks mined in the past two weeks alone, hinting at a surge in home mining. This promotes greater decentralization within the Bitcoin network because solo miners have little functional ability to censor. In contrast, large mining pools are points of failure that centralized interests can more easily pressure — to the detriment of activists and human rights defenders. The first block was mined on March 21 by a miner using a self-hosted FutureBit Apollo machine that earned 3.125 BTC plus fees for processing block 888,737. Just days later, a solo miner with under 1 TH/s of self-hosted hash rate found block 888,989, which became just the third block ever to be mined using an open-source Bitaxe device. Most recently, on March 24, a solo miner using a $300 setup successfully mined block 889,240.

Krux | Adds Taproot and Miniscript Support

Krux, open-source software for building your own Bitcoin signing devices (hardware for Bitcoin self-custody), released an update that enhances privacy and flexibility. The update introduces support for Taproot, a past Bitcoin upgrade that improves privacy and security, and Miniscript, a simplified way to create more complex Bitcoin transaction rules. This allows users to manage multi-signature wallets (where more than one private key is required to interact with your Bitcoin) in a more private and flexible way. It also enables spending conditions that are harder to censor and easier to verify. Krux continues to support the struggle for financial freedom and human rights by breaking down barriers to Bitcoin self-custody. HRF has recognized this impact and awarded grants to open-source developers working on Krux to advance this mission.

Cashu | Developing Tap-to-Pay Ecash

Calle, the creator of Cashu, an open-source Chaumian ecash protocol for Bitcoin integrated with the Lightning Network, is developing a new tap-to-pay feature that enables instant, offline ecash payments via NFC. Ecash functions as a bearer asset, meaning the funds are stored directly on the user’s device. With tap-to-pay, it can be transferred with a single tap (similar to tapping your credit card). More generally, ecash offers fast, private transactions resistant to surveillance and censorship. But for activists and dissenters, this particular advancement makes private and permissionless payments more accessible and user-friendly. This development will be worth following closely. Watch a demo here.

OpenSats | Announces 10th Wave of Bitcoin Grants

OpenSats, a public nonprofit that supports open-source software and projects, announced its 10th wave of grants supporting Bitcoin initiatives. This round includes funding for Stable Channels, which enable stabilized Bitcoin-backed balances on the Lightning Network (allowing users to peg Bitcoin to fiat currencies in a self-custodial way) that provide stable, censorship-resistant payments. OpenSats also renewed its support for Floresta, a lightweight Bitcoin node (a computer that runs the Bitcoin software). It lowers entry barriers to running Bitcoin, helping make the network more decentralized and censorship-resistant.

Bitcoin Policy Institute | Launches Bitcoin Summer Research Program

The Bitcoin Student Network (BSN) and the Bitcoin Policy Institute (BPI) are teaming up to offer students an eight-week research internship this summer. The program is part of BPI’s Research Experiences for Undergraduates (REU) initiative and invites students passionate about the future of money, financial inclusion, and Bitcoin’s civil liberties impacts to conduct hands-on research. Participants will also receive mentorship from BPI researchers. The program runs from June 9 to Aug. 8, 2025, and includes an in-person colloquium in Washington, DC. It is an incredible opportunity for students worldwide, especially those living in oppressive regimes, to get involved with Bitcoin. Applications are open until April 7. Apply here.

RECOMMENDED CONTENT

‘Principles of Bitcoin’ by Vijay Selvam

“Principles of Bitcoin” by Vijay Selvam is a new book offering a first-principles guide to understanding Bitcoin’s technology, economics, politics, and philosophy. With a foreword by HRF Chief Strategy Officer Alex Gladstein, the book cuts through the noise to explain why Bitcoin stands alone as a tool for individual empowerment and financial freedom. Selvam’s work makes the case for Bitcoin as a once-in-history invention shaping a more decentralized and equitable future. Read it here.

– If this email was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report here.

– Support the newsletter by donating bitcoin to HRF’s Financial Freedom program via BTCPay.

– Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing [email protected].

– The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals here.