Good morning, readers!

Iran’s largest digital asset exchange, Nobitex, was hit by a cyberattack in which $90 million in digital assets were intentionally drained and destroyed. The hacker group Predatory Sparrow also claims to have wiped records from Sepah Bank, one of Iran’s largest state-owned banks, and leaked Nobitex’s source code, exposing any remaining funds. The hack is an example of how centralized financial infrastructure may increasingly be targeted during geopolitical conflicts, presenting yet another reason why users, especially those living under authoritarian regimes, should consider custody of their Bitcoin.

Meanwhile, in India, thousands of people have had their bank accounts frozen without notice as part of what is being billed as a sweeping crackdown on cybercrime. While ostensibly intended to combat fraud and illicit activity, the measures are ensnaring ordinary citizens, many of whom are now unable to access savings or make basic transactions. Victims face long delays, lack of recourse, and even demands for bribes from bank officials, raising serious concerns over authoritarianism, corruption, and the erosion of financial rights in the name of enforcement.

In Bitcoin news, Blitz Wallet has added LNURL address support and experimental self-custodial zaps to its Spark-powered web wallet. LNURL allows users to create static, human-readable Lightning addresses that make payments easier and more consistent for non-technical human rights advocates. Additionally, self-custodial zaps are a promising development toward sending bitcoin micro-tips on nostr without relying on custodial solutions. With these tools, activists can — for example — use nostr to blog and easily get paid for their content anywhere in the world.

We conclude with a debate between HRF’s chief strategy officer, Alex Gladstein, and LayerTwo Labs CEO, Paul Sztorc, who discuss the notion of whether Bitcoin is failing to scale properly.

Here’s what you need to know.

Global News

Iran | Largest Digital Asset Exchange Hacked

Iran’s largest digital asset exchange, Nobitex, suffered a cyberattack in which over $90 million in Bitcoin and cryptocurrencies were deliberately destroyed (sent to unspendable wallets) rather than stolen. The group behind the attack, “Predatory Sparrow” (or Gonjeshke Darande), claims the action was intended to undermine Iranian state infrastructure, accusing Nobitex of financing Iran’s military operations. The group has also taken credit for wiping records from Sepah Bank, one of Iran’s largest state-owned banks, and has since leaked the Notibex source code, placing any remaining funds at risk. The attack, which occurred during a nationwide Internet blackout, shows a growing use of financial infrastructure as a front line in geopolitical conflicts and the risk faced by ordinary users who store assets on centralized exchanges in authoritarian regimes.

India | Thousands Report Frozen Bank Accounts as Officials Crack Down on Cybercrime

In Mangaluru, India, thousands of individuals are reporting their bank accounts frozen or marked with liens by officials without prior notice or due process. This comes as officials tighten surveillance and confiscation in the name of fighting cybercrime activity, with everyday Indians caught in the crossfire. Affected people are left unable to make basic transactions or access their savings. Some report that account recovery can take months. Many more share that the process of unfreezing bank accounts is opening the door to corruption. Certain bank officials are reportedly demanding bribes for a more timely account resolution. The real issue is that India’s approach to fighting cybercrime is ensnaring innocent people without adequate safeguards or recourse. Instead of directly targeting criminals, officials cast an overly wide net (sometimes based only on proximity to fraudulent transactions) and place the burden of proof on victims to clear their names.

Venezuela | Gold Grams Against Hyperinflation

In Venezuela’s remote mining town of El Dorado, access to financial services is as mythical as the city it’s named after. Home to 5,000 residents, most of whom work (officially or not) in gold mining. Camps dot the perimeter of the town. Families sift sand through their fingers in search of gold flakes. While others blowtorch impurities before gold is traded or sold. It can take hours to find even a fraction of a gram, and that’s just enough to buy maize meal or cooking oil. Despite the name, most of El Dorado’s residents remain poor. “If I don’t have gold, I have no life,” one merchant said. And while residents could offload their gold to dozens of dealers on the streets, most prefer to keep it in light of the bolivár’s 50% depreciation this year alone. This offers a stunning illustration of the second-order effects of Venezuela’s rapidly depreciating currency and immense financial repression. State policy has pushed an entire community into a makeshift gold economy, where groceries are priced in gold grams, and survival depends on what you can dig from the earth on a given day.

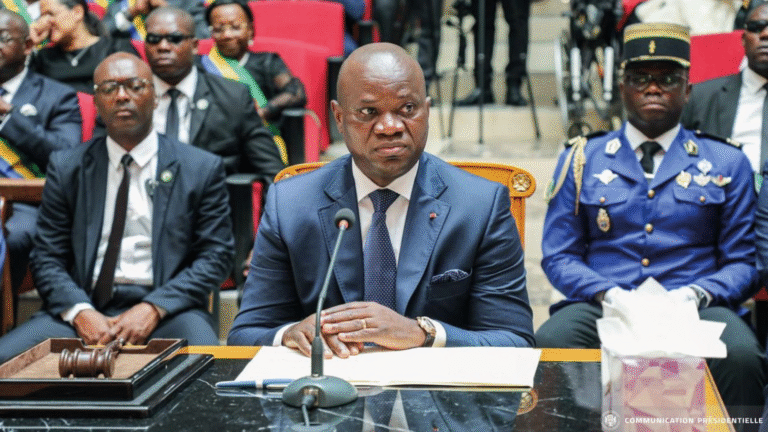

Togo | Protests Follow Constitutional Changes that Allow Indefinite Rule

Togolese citizens are rising up after President Faure Gnassingbé, already in power for two decades, implemented constitutional changes that allow him to assume a powerful new role with no term limits. Sworn in as “President of the Council of Ministers” in May, the Togolese parliament can now indefinitely re-elect Gnassingbé, bypassing the popular vote. Opposition leaders have denounced the move as a “constitutional coup,” and citizen protests erupted in Lomé and online despite a ban on demonstrations since 2022. It would be no surprise if these demonstrations are financially suffocated, given Gnassingbé’s long-standing use of the financial system as a tool of repression. There are also reports of police beatings, dozens of protestors in detention, and over 80 arrests. “A staggering 97%of the country’s citizens have lived under the shadow of a single ruling dynasty,” Togolese democracy activist Farida Nabourema said. “The Gnassingbés do not just run elections; they are the elections.”

Sudan | Inflation and Food Prices Continue to Rise

Sudan’s currency collapse is deepening. Inflation rose to 142.82% in May, with food prices jumping nearly 9% in just one month. Today, Sudanese families pay more than twice what they did last year for basic groceries. This crisis isn’t abstract. It’s what happens when a country simultaneously loses political agency and currency stability. Two years of civil war have decimated banks, severed aid routes, and turned cash into a liability, especially in RSF-held areas where new banknotes issued by the Sudanese government are banned. This financial collapse and political fallout has displaced more than 16,000 people in the past week. And refugees who do manage to flee across borders can’t open bank accounts or access financial services without a proper ID. Thankfully, grassroots efforts like the Bitcoin Innovation Hub in Uganda are helping Sudanese refugees learn to save, spend, and rebuild using censorship-resistant money.

Bitcoin News

Blitz Wallet | Introduces LNURL Addresses and Self-Custodial Zaps

Blitz Wallet, an open-source, self-custodial mobile Bitcoin wallet in beta, released support for LNURL and self-custodial zaps (bitcoin micro-tips on nostr) via its Spark-powered web wallet. LNURL is a Bitcoin address protocol that allows users to create static, human-readable Lightning addresses for payments (e.g., [email protected]). This means Blitz users can send and receive bitcoin payments asynchronously without having to copy and paste a string of alphanumeric characters. The addition of self-custodial zaps is also a promising addition toward greater financial sovereignty. But it’s important to note that because the Blitz web wallet is currently powered by Spark, users do not yet have a unilateral exit. They still need Spark’s cooperation to move funds into full self-custody. While in beta, these tools represent meaningful steps toward lowering friction and censorship risks in bitcoin payments for dissidents, human rights defenders, and nonprofits.

Ashigaru | Releases Zerolink Coinjoin Coordinator

Ashigaru, a project building open-source bitcoin tools, launched a new Zerolink CoinJoin coordinator, reviving a privacy tool for Bitcoin users following the closure of Samourai Wallet’s “Whirlpool.” CoinJoin is a collaborative Bitcoin transaction method that breaks links between senders and receivers by combining multiple users’ coins into a single transaction, making it difficult for a dictator to spy on dissident financial activity. Around the world, pro-democracy movements rely on Bitcoin to organize and resist authoritarian regimes that freeze bank accounts and surveil payments. But Bitcoin’s public ledger can expose dissidents and nonprofits to identification and extreme repression. CoinJoins provide a layer of plausible deniability, letting supporters fund movements without exposing themselves or the recipients.

Sorted Wallet | Implements Breez SDK for Bitcoin Lightning Payments

Sorted Wallet, a mobile wallet designed to bring Bitcoin payments to low-cost devices like feature phones and entry-level Androids, integrated the Lightning Network via the Breez SDK. Feature phones are used by hundreds of millions of people worldwide, especially by those living in authoritarian or underdeveloped regions. With this integration, these individuals can gain access to fast and low-cost bitcoin payments using the tools and devices they already have. In countries where smartphones are rare and banks are either inaccessible or untrustworthy, this gives people a basic but reliable way to save and send value via bitcoin that can lower the barrier to financial participation for some of the world’s most excluded communities.

Zeus Wallet | Adds Cashu Ecash Support

Zeus Wallet, a popular self-custodial Lightning wallet for mobile, introduced experimental support for Cashu, a Chaumian ecash protocol built on Bitcoin. Cashu enables fast, low-friction bitcoin payments with strong privacy properties, but users must trust the mints (custodians of ecash) to custody their funds. This integration is part of Zeus’s new graduated wallet system, which helps onboard new users by offering simple, private payments before guiding them toward full self-custody. With ecash support, Zeus lowers the barrier to entry for private Bitcoin usage and enhances the choices dissidents have over how they transact in the presence of authoritarian regimes.

Skibidi Wallet | New Bitcoin Wallet Designed for Youth

Skibidi Wallet is a new self-custodial Bitcoin Lightning wallet built with Gen Alpha in mind. The wallet combines gamification and Bitcoin to introduce foundational concepts of financial sovereignty in youth-oriented language. It integrates the Breez Nodeless SDK, enabling fast, low-fee Bitcoin payments for users without requiring technical expertise or node management. And it even includes a built-in 2D RPG that rewards engagement and helps teach core Bitcoin principles. In regions where traditional financial systems continue to limit opportunity for youth, Skibidi Wallet offers an early, hands-on path to financial agency. Learning to use open-source, censorship-resistant money from a young age provides the next generation with a deeper understanding of their financial rights and how to protect them in a digital world.

Geyser Fund | Nostr Wallet Connect (NWC) Hackathon Grant

The NWC Hackathon Grant is a new funding opportunity supporting open-source projects and developers that integrate Nostr Wallet Connect (NWC), a protocol designed to facilitate Lightning payments and communication between apps and wallets. This hackathon welcomes software and hardware projects in all stages. More than $10,000 in funding will be distributed across two chosen projects. The initiative seeks to encourage innovation in tools that enhance NWC’s role in the Bitcoin and Lightning ecosystems, contributing to greater financial sovereignty and freedom for all users, especially those building, operating, or living under tyranny. Learn more here.

Recommended Content

Is Bitcoin Failing? Alex Gladstein vs. Paul Sztorc Debate

In a debate on “What Bitcoin Did,” HRF Chief Strategy Officer Alex Gladstein and LayerTwo Labs CEO Paul Sztorc tackle a critical question: is Bitcoin falling behind? The pair debate whether the Lightning Network is failing, if privacy tools like ecash are a step forward or a compromise, and whether hard forks should be revived to spur progress. Sztorc argues Bitcoin is stagnating and becoming resistant to innovation, while Gladstein defends its antifragility and real-world utility for people in repressive regimes. It’s a “theory” versus “practice” exchange on Bitcoin’s future, well worth watching in full.