Good morning, readers!

Last week, El Salvador’s Congress approved constitutional changes allowing unlimited presidential reelections that would allow for President Nayib Bukele to run indefinitely. This comes just months after striking a $1.4 billion agreement with the IMF, repealing Bitcoin as legal tender, and introducing a foreign agents law that financially targets NGOs and civil society. Since then, the country’s top human rights group has been forced to leave the country, joining the more than one hundred journalists and lawyers who are now in exile.

Meanwhile, North Korean officials are closing down or merging foreign currency exchange centers with state-run currency exchange centers as the regime struggles to manage a widening gap between the “official” and market rate of the won currency. Services are also increasingly limited, with dollar purchases in Pyongyang capped at $20 per person, if allowed at all. North Koreans now face even greater barriers to saving, trading, or protecting their livelihood with any stability.

In freedom tech news, we feature PayPerQ AI, a Bitcoin-powered chat platform that offers AI access without subscriptions or credit cards. Built for global accessibility, PPQ lets anyone ask powerful models like GPT or Claude a question and pay in satoshis (the smallest denomination of Bitcoin). It’s a reminder that Bitcoin’s utility extends far beyond savings; it’s infrastructure for broader digital inclusion that can bring greater AI access to those on the margins of the financial system.

We end with a rapid-fire interview on the “21 in 21” podcast from Presidio Bitcoin, in which Alex Gladstein, chief strategy officer at the Human Rights Foundation, joins host Haley Berkoe to explore the intersection of Bitcoin, activism, and democracy.

Now, let’s get into the details.

Global News

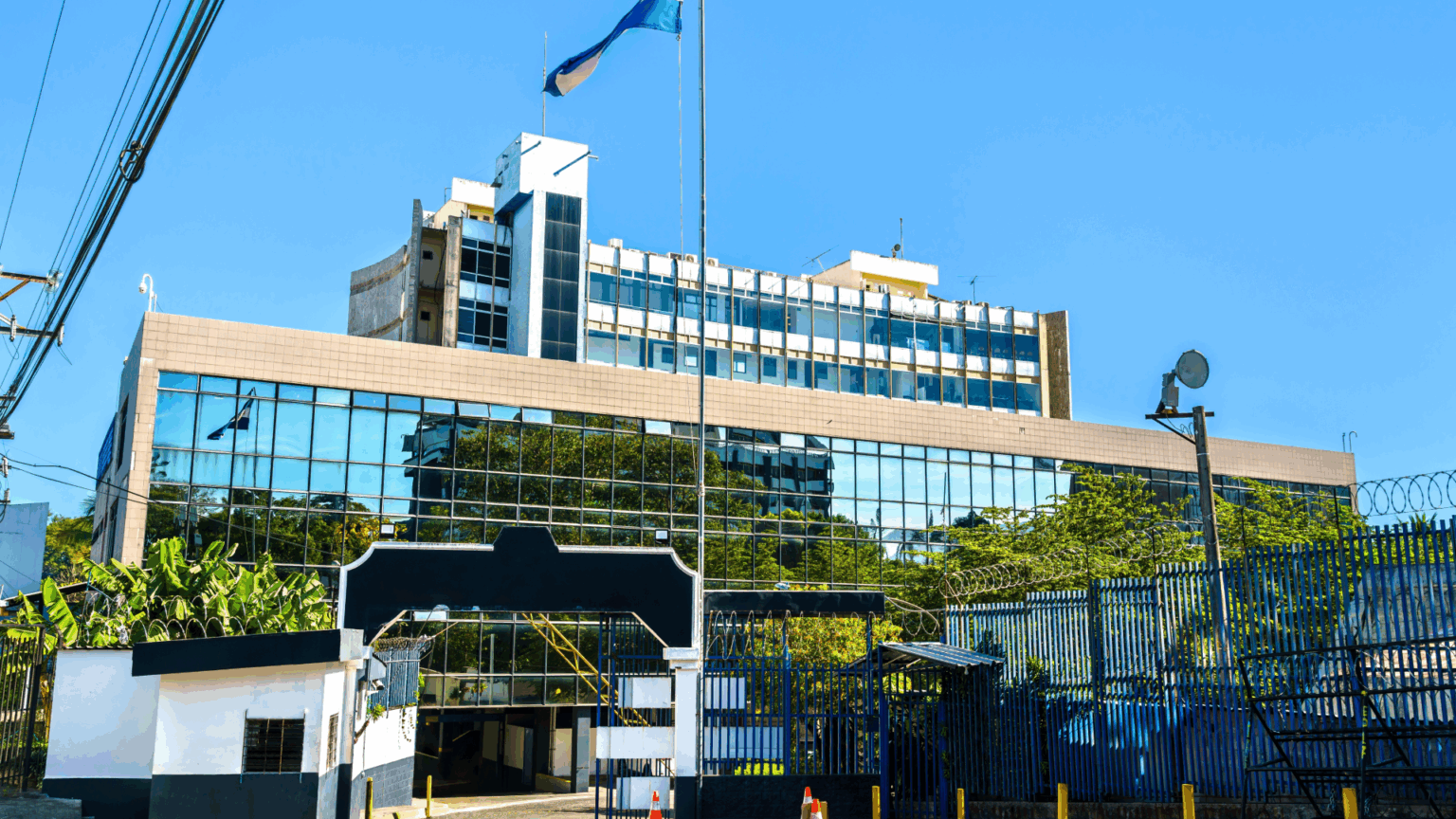

El Salvador | Congress Approves Unlimited Presidential Reelections

El Salvador’s Congress approved constitutional reforms that allow unlimited presidential reelections and extend presidential terms to six years, paving the way for President Nayib Bukele to remain in power indefinitely. The shift follows a $1.4 billion IMF agreement earlier this year, which saw the Salvadoran regime remove Bitcoin as legal tender, phase out the state-run Chivo wallet, and make Bitcoin acceptance voluntary for the private sector. In June, lawmakers then passed a foreign agents law imposing strict financial reporting and a 30% tax on organizations and individuals receiving international support. El Salvador’s leading human rights group, Cristosal, has since relocated operations abroad, citing legal pressure and state surveillance. More than one hundred activists, journalists, and lawyers have also fled the country. The dismantling of democratic safeguards and stifling of civil society in El Salvador suggest a shift toward greater state control over both political and economic life.

North Korea | Regime Shutters Currency Exchange Centers Amid Currency Crash

North Korean officials are consolidating and shuttering many foreign currency service centers as the regime struggles to manage a growing divergence between the “official” and market rate of the won currency. Previously located near markets and department stores, these service centers are being merged with service centers in state-run banks or closed entirely. In early July, the totalitarian dictatorship also issued an order suspending the exchange of euros, yen, and rubles outside of state-run banks. Exchange services are also increasingly limited, with dollar purchases in Pyongyang capped at $20 per person, if allowed at all. The won has also fallen in value from 8,300 to over 30,000 per US dollar in the past 18 months. But officials continue to push the official rate of 8,900 won per US dollar. When the exchange rate increased to 12,000 won in mid-2024, officials handed out “ideological materials” that ordered foreign currency service centers to maintain the 8,900 won per dollar rate.

Burma | Invasive Cybersecurity Law Comes into Full Effect

In January, this newsletter reported on a repressive cybersecurity law enacted by the military junta in Burma that empowers officials with sweeping controls over digital spaces. Last week, that law came into full effect. It criminalizes the use of VPNs, mandates that platforms store and hand over user data to officials upon request, and allows authorities to shut down Internet access at will. It also empowers regime-aligned law enforcement with the absolute authority to check citizens’ phones on the street. Penalties include up to six months in prison for sharing posts deemed “misinformation” or for using encrypted apps (like VPNs) to access information. Reports have already surfaced of police extorting bribes from people at checkpoints for having VPNs or “illegal social media” like X, Facebook, or YouTube on their phones. The law poses immediate threats to journalists and activists critical of the military regime or using privacy tools. Amid the junta’s effort to stage a sham election to expand militarized control, this deepens Burma’s retreat from civic freedoms and shrinks the already fragile space for independent voices and the free flow of information.

Iran | Proposes Removing Four Zeros From Currency

The Iranian parliament has approved the outline of a new bill to redenominate the rial currency by removing four zeros. The proposed change would convert 10,000 old rials into one new rial, a move officials say will simplify transactions and reduce their costs of printing money. In reality, it’s a quiet admission that the currency has already lost 99.99% of its value. While redenominations like this are not uncommon (Turkey, Romania, and Zambia have all done it in the past), it is purely a cosmetic measure. Even if this makes the rial a more manageable unit of account, it does nothing to curb the autocratic regime’s ongoing monetary debasement that has contributed to the currency’s complete collapse in purchasing power. For Iranians, who have borne the brunt of the rial’s collapse through a soaring cost of living, an inability to save, and increased poverty, this is less like a fix and more like a symbolic measure amid deep economic dysfunction.

Algeria | Bans All Digital Asset Activity

Algeria’s authoritarian government passed sweeping legislation banning all cryptocurrency-related activity, including ownership, usage, trading, mining, operating wallets, and even promotion. Officials argue the move is necessary to protect financial stability and prevent illicit finance. But the law applies universally, with no distinction between criminal abuse and legitimate use. Digital assets in any form are now treated as a financial crime. Penalties include up to one year in prison or fines exceeding 1,000,000 dinars ($7,600). While Bitcoin was already restricted since 2018, Algerians continued to use it underground, often to preserve savings or access scarce foreign currency as the Algerian dinar continued to slide. Whether this full-scale ban will work, simply drive activity further underground, or fundamentally change how a growing number of Algerians interact with Bitcoin remains to be seen.

Recommended Content

Human Rights and Financial Freedom: Bitcoin’s Impact in Burma, Thailand, and Laos

A new study from the Bitcoin Policy Institute, authored by HRF Global Bitcoin Adoption Fellow Win Ko Ko Aung, explores how individuals across Burma, Thailand, and Laos use Bitcoin to navigate financial repression, authoritarian control, and banking exclusion. In regions where press freedom is restricted, corruption is widespread, and local currencies are unstable, Bitcoin offers a permissionless alternative that helps people to store wealth, access aid, and engage in trade outside of state-controlled systems. The report also explains how Bitcoin’s peer-to-peer nature allows for greater autonomy in contexts where financial tools are weaponized against dissent or where traditional banking infrastructure is inaccessible. Read the full report here.

Bitcoin and Freedom Tech News

PPQ AI | Bitcoin-Powered AI Access

PayPerQ is a pay-per-query AI chatbot platform built by Bitcoin researcher and entrepreneur Matt Ahlborg. It lets users access powerful generative AI models (like ChatGPT or Claude) without needing a subscription or credit card. Instead, users pay per question using the Bitcoin Lightning Network, enabling microtransactions that make the service more accessible globally, especially in places where traditional payment methods are unavailable or unreliable. Inspired by years of research in places like Nigeria and Venezuela, where people rely on Bitcoin for practical use, Ahlborg launched PPQ as a way to bring AI tools to underserved communities and dissidents. His philosophy: “Subscriptions assume everyone has a credit card. Many people don’t.” In short, PPQ.ai combines AI access with Lightning payments, offering a more inclusive approach to interacting with large language models (LLMs).

Bitle | Run Your Own Bitchat Node

Bitle is a self-powered relay node designed to support Bitchat, Jack Dorsey’s new Bluetooth mesh network messaging app that works without Internet. Bitle extends Bitchat’s offline range by securely forwarding encrypted messages between devices. It operates as a passive mesh node, extending range without appearing as a peer in the Bitchat app interface. Bitle can run indefinitely on solar power or for 25 to 50 days on battery alone and has an estimated range of 300–500 feet. Together, Bitchat and Bitle offer activists and dissidents a lightweight, censorship-resistant communication system that can function in surveillance-heavy or infrastructure-poor environments, supporting coordination and communication even when dictators block online access.

Fedimint | Releases ‘Fedimint-in-a-Box’

Fedimint is a Bitcoin tool that helps communities, like families, friends, or civil society circles, jointly custody Bitcoin and transact in a private and low-cost manner. Until now, running a Fedimint required significant technical knowledge. But with the release of version 0.8.0, the project introduced “Fedimint-in-a-Box,” a one-click install package that makes it easy for anyone to host a Fedimint using platforms like StartOS and, soon, Umbrel. This removes one of the biggest barriers to Fedimint adoption: setup complexity. Activists and communities can now quickly spin up their own local and private financial rails without needing deep technical skills. It’s a step toward making private Bitcoin tools more accessible to people on the frontlines of financial repression. Fedimints are not without tradeoffs, though, as they are a custodial solution that requires users to trust the entities managing the Fedimint to not collude or seize funds.

Blitz Wallet | Migrates to Spark

Blitz Wallet has officially migrated to the Spark protocol, a payment layer for Bitcoin designed for faster and cheaper transactions. By integrating Spark, Blitz wallet eliminates the need for inbound liquidity, enabling instant Lightning payments. This makes it a more powerful Bitcoin onboarding tool for users new to the ecosystem, such as human rights defenders seeking greater financial agency under authoritarian regimes. Lightning Network URL (LNURL) support and offline receiving are now also built into Blitz, making it more accessible in low-connectivity environments. This migration to Spark follows the protocol’s recent rollout of unilateral exit, a feature that lets users reclaim their funds on-chain without needing cooperation from Spark operators. By removing reliance on intermediaries, the move makes Blitz Wallet’s transition to Spark significantly safer for users. With that said, both Spark and Blitz Wallet are in beta and are only suitable for small amounts of funds.

Dada Devs | Partners with Bitcoin Design Foundation

Dada Devs, an education initiative created by HRF grantee Lorraine Marcel focused on advancing women’s development and coding skills across Africa, partnered with the Bitcoin Design Foundation to expand UI/UX training for women in the Bitcoin development space. This collaboration will provide participants with hands-on experience in designing intuitive, inclusive, and open-source freedom tools. The partnership aims to build local capacity for user-first financial technology and strengthen Africa’s growing Bitcoin developer ecosystem. And in doing so, it aims to improve the accessibility of freedom tech in Africa and diversify the developer base of Bitcoin.

Recommended Content

‘21 in 21’ Presidio Bitcoin Podcast with Alex Gladstein

In this rapid-fire style interview on the “21 in 21” podcast from Presidio Bitcoin, Alex Gladstein, chief strategy officer at the Human Rights Foundation, joins host Haley Berkoe to explore the intersection of Bitcoin, activism, and governance. Gladstein shares how AI tools are helping human rights defenders build freedom tools and organize. He emphasizes the importance of localized governance that exists to serve the people in a genuinely free society. He also dives into HRF’s work funding open-source Bitcoin tools for those living under authoritarian regimes. A great listen for anyone interested in the real-world impact of freedom tech. Watch it here.